Following Contractor Voices recently exposing that Orange Genie has been systematically skimming from contractors’ salaries for years, we have been inundated with contractors submitting their payslips for auditing and raising concerns over umbrella payroll compliance.

As well as hundreds of new payslips and concerns over Orange Genie to add to our bulging evidence file to support our allegations against them, concerns raised by contractors over Liquid Friday’s fees could not be ignored. Therefore, Contractor Voice questions whether they are as transparent as its marketing would have the sector believe.

Following further investigations and obtaining supporting evidence, we conclude that an equally intentional and difficult to spot additional deduction is included by Liquid Friday, making the company fee significantly higher – to the tune of 1.5% every time.

Our investigations and number crunching shockingly reveals that Liquid Friday is making millions of pounds by hiding in plain sight an additional fee that has been costing contractors dearly every single week for years.

As with Orange Genie, the 1.5% that Liquid Friday charge for “Business Overheads” is not broken down on the payslip. Instead, an aggregate figure of Employer’s National Insurance, Apprenticeship Levy and the 1.5% deduction is provided, making it virtually impossible for contractors to see the true cost of using Liquid Friday as their umbrella, without a payslip audit. Undoubtedly, the practice of a disguised additional deduction on a payslip can only be facilitated on instruction to the payroll software provider.

The FCSA code of compliance clearly requires that “the pay reconciliation you [the umbrella company] provide to the employee transparently show an itemised breakdown of all employer costs, including but not limited to the Apprenticeship Levy.” (FCSA Umbrella Employment code of compliance, A17, page 9).

The “Business Overheads” charge

From documents provided to us by contractors and confirmation provided by Liquid Friday’s live chat operators, it charges 1.5% of all gross assignment invoices for what it calls “Business Overheads”. When questioned, the only “Business Overhead” example that is provided is the cost of the insurances that it provides as an umbrella employer.

Let’s do some basic number crunching using:

- £35 per hour

- For a contractor working 40 hours per week

- 113,000 payments made for the final year ending 31st July 2021 (as per filed accounts)

£35 x 40 hours = £1,400 per week

1.5% Business Overheads charge = £21 per week

£21 per week x 113,000 payments = £2,373,000 per year

So, even with just £35 per hour and only 40 hours per week, that’s £2,373,000 per year to cover the cost of insurance that, according to our research, should not cost any more than £150,000 per year. Therefore, we ask, how on earth can the 1.5% charge be justified when it results in an additional secret profit of millions of pounds every year?

What does this mean for contractors?

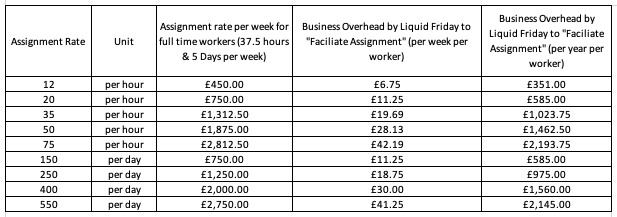

For readers and, in particular contractors, to see the actual cost to them on a weekly and annual basis, this table clearly sets out the extra money being taken from them by Liquid Friday as a disguised additional income.

Liquid Friday have tried to be clever in an attempt to legitimise the 1.5% additional charge by including it in KID’s and employment agreements. However, in the opinion of Contractor Voice, few contractors would have signed up with Liquid Friday if they had been transparent and explained that the “Business Overheads” charge was actually just another way to increase its headline margin fee.

The Liquid Friday website states it has 10,000 + happy contractors. That being the case, and factoring variables including contractors being charged out at higher rates and working many more hours, we conservatively estimate at least £10,000,000 of additional revenue has been earned by Liquid Friday by charging for the cost of insurance.

Let’s not forget that the Business Overheads charge is in addition to the traditional umbrella margin of up to £25 per week paid by many contractors. Isn’t the margin intended to be used to cover all business overheads, which should include the mandatory insurance that Liquid Friday is legally required to provide?

Is it legal to make a profit when charging for insurance?

Liquid Friday is not regulated by the Financial Conduct Authority (FCA) to sell insurance, nor is it an appointed representative or agent for the purpose of selling insurance. So, how can it legally charge for insurance and make such a huge profit on charging for it?

As far as Contractor Voice is aware, all other umbrellas accept that the cost of the insurance they provide for their contractors is a business overhead that they pay for out of the traditional umbrella margin that they legitimately charge. So, we urge Liquid Friday to explain the legal basis on which they charge contractors for the insurance it has to provide to be an FCSA member and to operate in the sector.

Assuming for now that it is not acting illegally and in breach of FCA regulations, how can Liquid Friday justify the 1.5% charge that has resulted in many millions of pounds more than the true cost of the insurance it has provided over the years?

Is Liquid Friday the most expensive umbrella in the UK?

Well, the figures speak for themselves! Using our figures, it appears that the true charge for an average contractor is £46 per week. Higher earning contractors could easily be charged in the region of £75 + per week!

When umbrellas that provide compliant services are charging transparent all-inclusive reasonable margin fees of £15 to £25 per week, in a challenging economic climate with an ever-increasing cost of living, we believe that it is shameful that Liquid Friday has and continues to exploit contractors, many of whom will struggle to pay their energy and food bills this coming winter.

Has the Business Overheads charge been sanctioned by the FCSA and its assessors?

The sector really does need this answering, especially as this exposé is just one of a series from Contractor Voice that calls into question why assessors are not spotting the financial wrongdoing of the FCSA members that they supposedly thoroughly assess, before signing them off as compliant and fit and proper businesses.

Contractor Voice wonders what documentation Liquid Friday has given to the assessors year on year since it first became an FCSA member? What relationship does Liquid Friday have with its assessors and are the recent incoming changes to assessor/member engagements a result of the FCSA discovering practices that intentionally breach its Code?

Stated at the beginning of the FCSA’s Code of Compliance is that neither it nor its assessors will look behind the documents and evidence its members submit for assessment, and they will only rely on what is provided by the member. Contractor Voice believes that part of the Code needs a complete overhaul, which should not be an issue for the FCSA as it has publicly stated it is looking into undoing the cosy member/assessor relationships.

Contractor Voice urges the FCSA to publicly confirm it will immediately commence an investigation into the conduct of Liquid Friday, including a review of all documentation is has submitted to FCSA assessors over the years and what those assessors said about the extra charging.

Why have FCSA members been reaccredited when they do not provide a clear breakdown on payslips as per the FCSA’s own Code? Are these calculations being checked during the assessments? And if not, why not? How many other FCSA members are doing the same thing?

Liquid Friday, let’s be transparent and hear from Joe

Contractor Voice calls upon Joe Taffurelli, Chief Operating Officer at Liquid Friday and spokesman for it, to make a public statement to the sector to explain why and how it can charge an additional 1.5%, without a transparent breakdown on payslips, and make such a significant profit from it.

From his very frequent online posts, Joe seems like a nice guy that portrays an impression of wanting to do the right thing for contractors and to be transparent, so we look forward to reading his comments in the very near future.